EOSB Rules for Limited vs. Unlimited Saudi Contracts

By Saad AlSahli Last updated: Feb 9, 2026 , LL.M. (Intl. Commercial Law, Univ. of Sussex) | Saudi Licensed Lawyer

The employment contract's term - Limited (Fixed) or Unlimited (Indefinite) - is the single most significant factor in determining an employee's rights and liabilities upon separation in Saudi Arabia. This comprehensive guide details the legal distinctions between the two contract types and the specific rules governing termination, notice periods, and EOSB entitlement for each.

I. Core Contract Definitions and Conversion Rules

The Saudi Labor Law governs the establishment and duration of employment relationships, recognizing two primary types of contracts: Limited (Fixed-Term) and Unlimited (Indefinite-Term).

A. Legal Framework for Contract Duration

Limited (Fixed-Term) Contracts

A fixed-term contract is defined by a specific duration, and it terminates automatically upon the expiration of its specified term.

Mandatory Fixed Term for Non-Saudis (Article 37): For non-Saudi workers, the employment contract must be written and for a fixed term. If the contract for a non-Saudi worker fails to specify a duration, the contract duration is deemed to be one (1) year from the start date. If the work continues after this initial duration expires, the contract is considered renewed for a similar period.

Unlimited (Indefinite-Term) Contracts

An indefinite-term contract is one that does not specify an end date or is one that has converted from a limited term based on renewal rules.

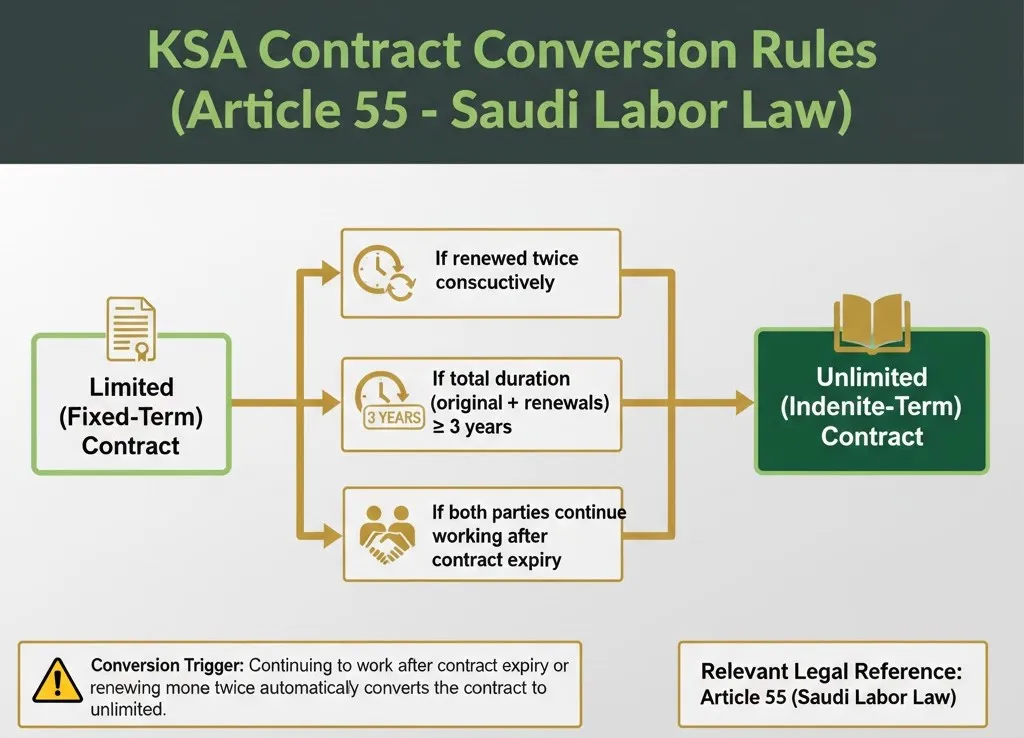

Automatic Conversion Rule (Amended Article 55)

A limited contract may automatically transform into an unlimited contract under specific statutory conditions:

- Continuation after Expiration: If a fixed-term contract expires, but both parties continue to execute it, the contract is deemed renewed for an indefinite period of time.

- Renewal Limits (Conversion Trigger): If a fixed-term contract is renewed twice consecutively, or if the original contract term along with the renewal periods reaches three years (whichever period is shorter), and the parties continue execution, the contract shall then be considered an indefinite-term contract. This affects the notice requirements for Termination of Unlimited Contract: Notice & EOSB.

Limited (Fixed-Term) → Renewed Twice OR ≥ 3 Years → Unlimited (Indefinite-Term) Contract.

⚠️ Conversion Note

The most critical trigger for conversion to an unlimited contract is either continuing to work after the original term expires or renewing a Limited Contract for the third time.

B. EOSB Calculation Basis

The End-of-Service Award (EOSB) calculation methodology is dictated by the service period and the worker's last wage, as detailed in Article 84 of the Labor Law.

Calculation Rate (Article 84)

The gratuity is calculated based on the following scale: Half-Month Wage for the first five years, and One-Month Wage for each year succeeding the first five years. The worker is entitled to the EOSB for portions of the year proportional to the time they spent working. Read our full EOSB Calculation Guide for wage components.

Wage Basis

The EOSB calculation must be based on the Actual Wage (Basic Wage plus included allowances). As an exception to Article 8, the parties may agree that not all or some amounts derived from commissions, sales percentages, or similar variable wage components shall be included in the EOSB calculation.

II. Termination/Resignation Rules for Unlimited (Indefinite-Term) Contracts

An unlimited contract provides flexibility but requires strict adherence to notice periods.

A. Termination by Either Party for a Legitimate Reason (Article 75)

If an indefinite-term contract is terminated, the party initiating the termination must provide a written notice with a legitimate reason.

| Initiating Party | Worker’s Payment Schedule | Minimum Notice Period |

|---|---|---|

| Employer | Monthly Paid Worker | At least sixty (60) days prior to termination. |

| Worker (Resignation) | Monthly Paid Worker | At least thirty (30) days prior to termination. |

| Both (Non-Monthly Paid Worker) | At least thirty (30) days prior to termination. | |

Consequences of Non-Compliance (Article 76): If the terminating party fails to observe the required notice period, they must pay the other party compensation equal to the worker's wage for the duration of the notice period.

B. End-of-Service Entitlement upon Worker Resignation (Article 85)

When an employee resigns from an unlimited contract, their entitlement is scaled based on continuous service length:

- Partial Entitlement (1/3): Service duration of 2 to 5 years. See One-Third EOSB Entitlement Rule.

- Partial Entitlement (2/3): Service duration of 5 to 10 years. See Two-Thirds EOSB Entitlement Rule.

- Full Entitlement: Service duration of 10 years or more. See Full EOSB Entitlement Rule.

C. Termination by Employer for an Invalid Reason (Article 77)

If the employer terminates for an invalid (illegal) reason:

- Compensation Rate: Indemnity equivalent to fifteen (15) days' wage for each year of service.

- Minimum Guarantee: Compensation must not be less than the worker’s wages for two (2) months.

- EOSB Entitlement: The worker receives the full End-of-Service Award (Article 84).

III. Termination/Resignation Rules for Limited (Fixed-Term) Contracts

Any termination before the scheduled expiration date is considered an early termination, triggering specific liabilities.

A. Early Termination by Employee (Unlawful Resignation) (Article 77 and 85)

If a worker terminates a limited contract early without a legitimate reason (Article 81 case):

- Compensation Liability to Employer (Article 77): The worker is liable to compensate the employer an amount equivalent to the wages for the remaining duration of the contract (minimum of two months' wages). See Early Termination of a Limited Contract by Employee.

- EOSB Entitlement: If the worker meets the minimum continuous service period of two years, they still receive the proportional EOSB award specified under the resignation rules of Article 85 (1/3, 2/3, or full).

B. Early Termination by Employer for an Invalid Reason (Article 77)

If the employer terminates a limited contract prematurely for an invalid reason:

- Compensation Rate: The aggrieved worker is entitled to compensation equivalent to the wages for the remaining duration of the contract.

- Minimum Guarantee: Compensation must not be less than the worker’s wages for two (2) months.

- EOSB Entitlement: The worker receives the full End-of-Service Award calculated under Article 84.

IV. Cases of Full EOSB Deprivation (Article 80) and Full Entitlement (Article 81)

A. Termination by Employer Resulting in EOSB Deprivation (Article 80)

The employer may terminate the worker's contract without an award (EOSB), advance notice, or indemnity if the worker is guilty of one of the following serious acts of misconduct:

- Assault against the employer or superiors during or because of work.

- Failure of Essential Obligations or deliberate disobedience/disregard of safety instructions (after written warning).

- Misconduct or Infringement on Integrity (e.g., dishonesty or theft).

- Intentional Material Loss (must be reported to authorities within 24 hours).

- Forgery to obtain the job.

- Unjustified Absence for more than twenty days (intermittent) or ten consecutive days (after warnings).

- Unlawful Personal Gain or Disclosure of Secrets.

Read the definitive 10 Cases for EOSB Deprivation Under Saudi Article 80.

B. Worker Leaving with Full Statutory Rights (Article 81)

A worker has the right to leave their job without notice while retaining all their statutory rights, including the full EOSB award (regardless of service length) if:

- The employer fails to fulfill their essential contractual or statutory obligations.

- The employer resorted to fraud at the time of contracting.

- The employer assigns the worker to work that is substantially different without consent.

- The worker or family member is subjected to violent assault or an immoral act by the employer/manager.

- Treatment is characterized by cruelty, injustice, or insult.

- A serious workplace hazard exists and the employer failed to take remedial measures.

V. Final Settlement Timelines and Deductions (Article 88)

The law mandates strict deadlines for the employer to settle a worker's final entitlements.

A. Payment Timeline (Article 88)

| Termination Initiated By | Worker Type | Maximum Payment Deadline | Legal Article |

|---|---|---|---|

| Employer (or Contract Expiry) | Monthly Paid Worker | Within one week from the date the contract ended. | Article 88 |

| Worker (Resignation) | Monthly Paid Worker | Within two weeks from the date the contract ended. | Article 88 |

B. Allowable Deductions (Article 88)

The employer is permitted to deduct any work-related debt owed to them from the final amounts due. However, deductions are strictly limited:

- Damages/Fines: Limited to five-day wage per month.

- Employer Loans/Debts: Cannot exceed 10% of the worker's wage.

- Maximum Total Deduction: May not exceed half (50%) of the worker's due wage, unless ruled otherwise by the Commission for the Settlement of Labor Disputes.

Any unresolved disputes or questions regarding specific entitlements or interpretations between employers and employees must be formally directed to the relevant Saudi authorities (such as the Ministry of Human Resources and Social Development or the labor courts) for official clarification and binding decisions.

Your Contract Type is the Key. Know Your Rights and Liabilities.

Are you on a Limited or Unlimited contract? Your termination rights, notice period obligations, and final EOSB entitlement depend entirely on this distinction, which can even change through automatic conversion rules (Article 55).

Use our Saudi End-of-Service Benefits Calculator to instantly determine the financial impact of your separation. Our tool is the only one built to analyze your Contract Type (Limited/Unlimited), Service Duration, and Reason for Separation to provide an accurate, legally compliant EOSB estimate.

Use Our End-of-Service Benefits CalculatorFAQs about EOSB Rules for Limited vs. Unlimited Contracts Types in Saudi Arabia

What are the two primary types of employment contracts recognized under Saudi Labor Law?

When does a Limited (Fixed-Term) Saudi contract automatically convert into an Unlimited contract?

- The contract expires, but both parties continue to execute it.

- The contract is renewed twice consecutively, OR the original term plus renewals reaches three years (whichever period is shorter).

How is the End-of-Service Award (EOSB) calculated in Saudi Arabia?

- Half-Month Wage for the first five years of service.

- One-Month Wage for each succeeding year after the first five years.

What is the minimum notice period required to terminate an Unlimited Saudi contract?

- Employer Termination: Minimum notice period of sixty (60) days for a monthly paid worker.

- Worker Resignation or Non-Monthly Worker Termination: Minimum notice period of thirty (30) days.

What are the End-of-Service Benefit entitlements when an employee resigns from an Unlimited contract?

- Partial Entitlement (1/3): Service duration of 2 to 5 years.

- Partial Entitlement (2/3): Service duration of 5 to 10 years.

- Full Entitlement: Service duration of 10 years or more.

What compensation is due if an employer terminates a contract for an invalid (illegal) reason (Article 77)?

- Compensation Rate: Indemnity equivalent to fifteen (15) days’ wage for each year of service (for Unlimited contracts). For Limited contracts, the compensation is equivalent to the wages for the remaining duration of the contract.

- Minimum Guarantee: The compensation must not be less than the worker's wages for two (2) months.

- EOSB Entitlement: The worker receives the full End-of-Service Award calculated under Article 84.

Under what circumstances can an employer terminate a worker without providing the EOSB award or notice?

- Assault against the employer or superiors.

- Failure of essential obligations or deliberate disobedience of safety instructions (after written warning).

- Unjustified absence for more than ten consecutive days or twenty intermittent days (after warnings).

- Misconduct, dishonesty, or forgery to obtain the job.

What are the required timelines for an employer to pay a worker's final settlement?

- Employer Termination or Contract Expiry: Within one week from the date the contract ended.

- Worker Resignation: Within two weeks from the date the contract ended.

In-depth Topics for Saudi EOSB Contracts

Explore focused guides related to contracts and how contract type affects EOSB entitlement.

Saudi Limited Contract Breach: Liability (Art 77) & EOSB (Art 85)

Unlawful limited contract breach. Calculate compensation liability (remaining wages, min 2 months - Art 77) & proportional EOSB (1/3, 2/3 - Art 85).

Read more →Saudi Unlimited Contract Termination: 60-Day Notice (Art 75)

SLL rules for unlimited contract termination. Mandatory 60-day (employer) or 30-day (worker) notice (Art 75). See resignation tiers (Art 85).

Read more →